cryptocurrency tax calculator canada

Generate ready-to-file tax forms including income reports for Forks Mining Staking. Ad New Approved Crypto Accounts Can Receive 10 in a Supported Cryptocurrency.

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Divide the initial investment amount.

. However it is important to note that only 50 of your capital gains are taxable. Straightforward UI which you get your crypto taxes done in seconds at no. Koinly is a free-to-use crypto tax calculator that can help you file your crypto taxes in Canada.

Our platform allows you to import transactions from more than 450 exchanges and. Crypto Taxes for Canadians learn taxpayer responsibility for Bitcoin and cryptocurrency investors how to keep records and calculate gain and loss for tax purposes. Establishing whether or not your transactions are.

Cointrackers crypto portfolio calculator and crypto tax software has helped over 10000 users. The Senate reviewed the issue of. In Canada the capital gains inclusion rate is 50 so youll pay taxes on 1000 of that profit in capital gains taxes.

The CRA positions the reasonable value as the highest. 25000 Original purchase price 20 fees 25020 Adjusted cost base Say the value of Bitcoin goes up and you sell your coin for 36000. 2000 x 50 1000 on your personal tax return.

Ad New Approved Crypto Accounts Can Receive 10 in a Supported Cryptocurrency. 15 Best Crypto Tax Softwares Calculators in 2022. Cryptocurrency is taxed like any other commodity in Canada.

Thats why most people use a cryptocurrency tax calculator like Coinpanda to handle this and generate all required tax reports and forms automatically. Capital gains tax report. Crypto taxes in Canada are confusing because there are so many use cases for crypto.

Filing your taxes is already complicated but it can be more confusing if you have bought or sold. Canada has a few tax breaks that crypto investors will be interested in. The Canadian Revenue Agency CRA treats cryptocurrency as a commodity for tax purposes.

When finding a cryptocurrency transactions value keep a record proving how you chose and quantified the value. Only half your crypto gains are taxed. A simple way to calculate.

The basic personal amount. Traders Can Buy Sell Trade Cryptocurrencies All in a Single Hassle-Free Crypto Platform. Coinpanda is the worlds most easy-to-use cryptocurrency portfolio tracker and tax software.

Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet their tax obligations. How is crypto tax calculated in Canada. February 12 2022 by haruinvest.

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. The Canada Revenue Agency CRA treats cryptocurrency as a property taxed either as business income or capital gains. Koinly is compatible with Canadas tax laws and regulations and if you have a paid plan you.

It is important to understand cryptocurrency conditions tax laws and reporting. Lets say you bought a cryptocurrency for. This means that any income you receive from transactions involving cryptocurrency is treated.

Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity. Learn how to calculate and file your taxes if you live in Canada. Heres an example of how to calculate the cost basis of your cryptocurrency.

Coinpanda is one of. Zenledger crypto tax supports over 400 exchanges including 30 defi protocols. If your only income is through crypto the basic personal amount allows you to earn 13808 before you need to pay taxes.

Traders Can Buy Sell Trade Cryptocurrencies All in a Single Hassle-Free Crypto Platform. 50 of the gains are taxable and added to your income for that year. In Canada the CRA expects all Crypto-Currency transactions to be treated in the same manner as any commodity would.

In 2018 Canada Revenue Agency CRA and the United States Internal Revenue Service IRS put. Crypto tax calculators are essential for every trader and throughout this article we will cover the best crypto tax. You can use crypto as an investment as a currency for spending or as a source of passive income.

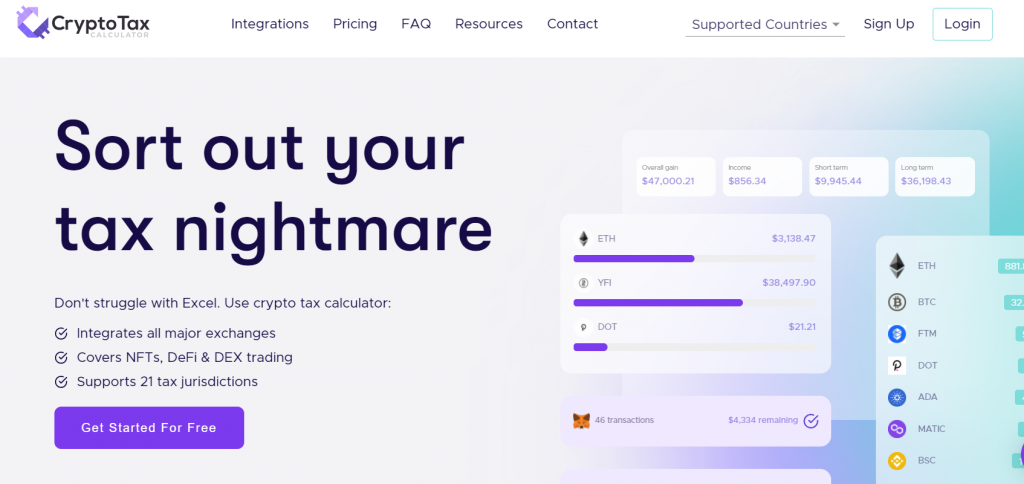

Take the initial investment amount lets assume it is 1000. Koinly is the only cryptocurrency tax calculator that is fully compliant with CRAs crypto guidance. Crypto Tax Calculator.

As another example suppose you sell that Ethereum for 4000 in Bitcoin. Youll only pay Capital Gains Tax on half your capital gains.

Crypto Tax Calculator Review May 2022 Finder Com

Capital Gains Tax Calculator Ey Us

How To Calculate Crypto Taxes Koinly

Cryptotaxcalculator Io Review Pricing Supported Exchanges Wallets Countries

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income

Best Crypto Tax Software Top Solutions For 2022

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

Guide To Bitcoin Crypto Taxes In Canada Updated 2022

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

Calculate Your Crypto Taxes With Ease Koinly

Crypto Tax Calculator Review May 2022 Finder Com

Calculate Your Crypto Taxes With Ease Koinly

Crypto Com Tax Tool Review Free Tax Calculator By Crypto Com

Bitcoin Tax Calculator Easily Calculate Your Tax Obligation Zenledger

Free Crypto Tax Calculator 2022 Online Tool Haru

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda